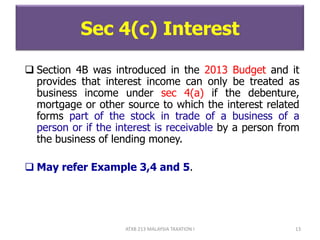

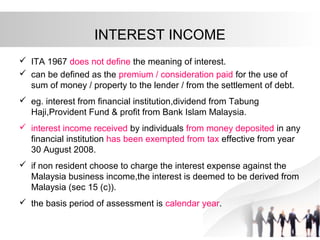

Loans to companies persons etc. Additionally where interest is paid to a non-resident the interest derived or deemed derived from Malaysia is subject to withholding provisions.

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

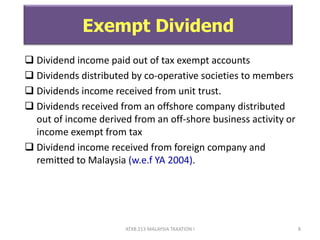

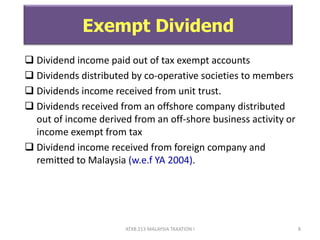

Income that you dont need to pay taxes for.

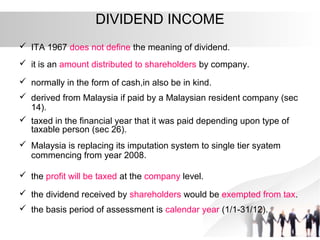

. Interest from the refund of excess employees CPF contributions. However foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced which is received in Malaysia is no longer be exempted with. Effective from YA 2014 Section 140B of the MITA was introduced to deem the interest income from loans or advances to directors as taxable income of the lending company.

RM300000 Interest restricted ----- x RM40000 RM400000 RM30000 RM30000 has to be added back in the companys tax computation which means only RM10000 is deductible as a business expense. Interest earned on fixed deposits is taxable as per the Income Tax Act 1961. This type of income is excluded from counting as your taxable income.

Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. While Malaysian resident investors will need to declare the interest earned as interest in their annual income tax returns the P2P financing operators will directly deduct 15. The determination of the source of interest income is significant as only interest derived from Malaysia is taxable in Malaysia.

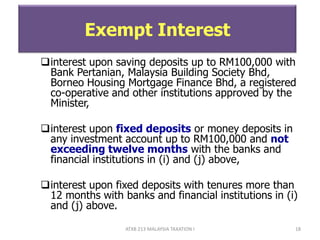

If you have FD in one or more bank accounts you should aggregate FD interest from all the banks and declare it as a taxable income under the head Income from Other Sources in the income tax return. When the income from the interest of a fixed deposit exceeds Rs 40000 the bank or financial institutions deducts tax at source in the form of tax from the depositor. Income in respect of interest received by individuals resident in Malaysia from money deposited with the following institutions is tax exempt with effect from August 30 2008.

How is interest income from fixed deposits taxable. 4c Interest Income Savings and Fixed Deposit from a Malaysian Bank P2P Lending Activities in Malaysia Lending to Steve Ma Sdn Bhd. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

The IRBM also issued PR82015 on Loan or Advances to Director by a Company to explain on the tax treatment of interest income deemed to be received by the company from the loans or. Bank of China Fixed Deposit Account. Agrobank Fixed Return Investmnet Account-i 45 Plus.

Things like parking and childcare allowances which fall under Perquisites above can also be exempted from tax. For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax. A bank or a finance company licensed or deemed to be licensed under the Banking and Financial Institutions Act 1989.

An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits. Yes the interest income from a fixed deposit is taxable. When the income from the interest of a fixed deposit is less than Rs 40000 in a year tax is not applicable.

RM30000 has to be added back in the companys tax computation which means only RM10000 is deductible as a business. Fixed Salary RM 7000 a month x 12 monthsTaxable Amount on Richards Interest Savings. Valuations of some types of employment income.

Deposits with finance companies not licensed in Singapore. The bank deducts tax deduction at source at the rate of 10 per annum if PAN. RM20000 182 RM365.

Deposits with non-approved banks in Singapore. Interest that accrues in respect of any savings deposited with Bank Simpanan Nasional BSN. The interest restriction is computed using the formula in paragraph 62 of this Ruling as follows.

Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer. An individual resident in Malaysia is exempt from tax in respect of the interest received from the following savings or investments-i. Let us explain what the numbers mean Looking at the first 1 formula youd have to divide your yearly interest rate by 12 to get the rate at which your deposits earn interest for each month of the year then multiply that.

Interest from the following sources is taxable. A bank licensed under the Islamic Banking Act. Interest or bonus which accrues in respect of money deposited with Bank Simpanan Nasional under the Save as You Earn scheme.

Deduction from Personal Relief 20000 Total Taxable Income. Bank Muamalat Fixed Term Account-i.

Chapter 5 Non Business Income Students

In The Matter Of Interest Crowe Malaysia Plt

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Cukai Pendapatan How To File Income Tax In Malaysia

How Much Tds Is Deducted On Bank Company And Nro Fixed Deposits Nri Banking And Saving Tips Savings And Investment Investment Tips Investing

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account

9 Types Of Taxable Income In M Sia That You Never Knew

Chapter 5 Non Business Income Students

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Income Tax Testbankanssss Pdf Tax Deduction Taxpayer

Interest Vs Profit Difference Between Bank Company Income Analyst Answers

Ktps Consulting Deemed Interest Income Facebook

Chapter 5 Non Business Income Students

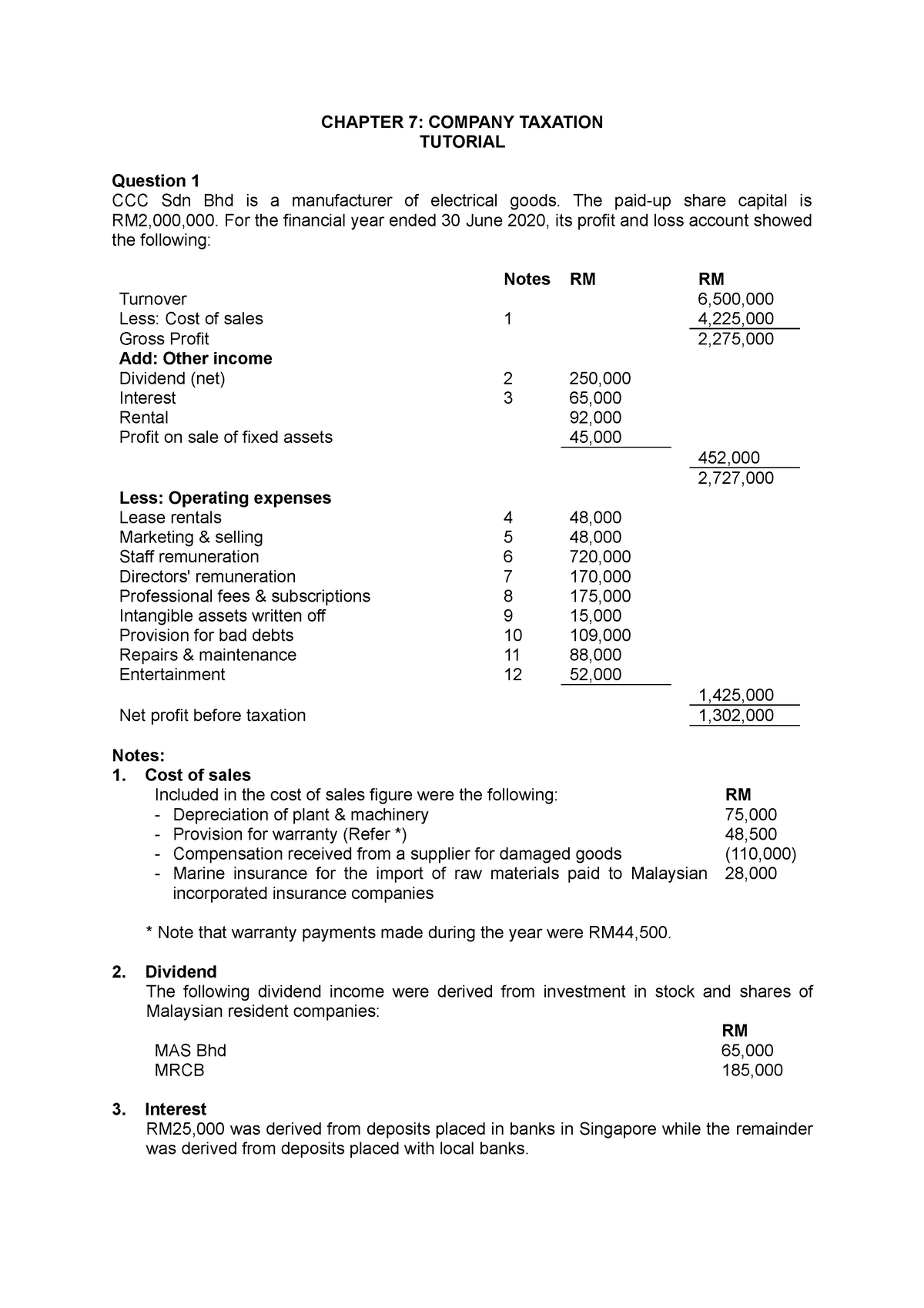

Chap 9 Tutorial Company Taxation Chapter 7 Company Taxation Tutorial Question 1 Ccc Sdn Bhd Is A Studocu

Taxation Principles Dividend Interest Rental Royalty And Other So

Corporate Income Tax In Malaysia Acclime Malaysia

Personal Income Tax Interest Income Tax Treatment

Taxation Principles Dividend Interest Rental Royalty And Other So